The Paychex | IHS Markit Small Business Employment Watch data for October again reflects the tight labor market with a dip in job growth and uptick in wages. Down 0.06 percent from last month at 99.12, the Small Business Jobs Index has slowed 1.28 percent over the past two years, consistent with a declining rate of unemployment in the same timeframe. The rate of hourly earnings growth in October stands at 2.41 percent ($0.63), increasing for the second month in a row.

“The national index has dropped 0.77 percent in the past year and 1.28 percent in the past two years,” said James Diffley, chief regional economist at IHS Markit. “This slowdown in small business employment growth has coincided with the sharp fall in unemployment over the past two years.”

“According to the latest Paychex Business Sentiment Report, released yesterday, business owners rank their ability to fill open positions with qualified candidates as a top challenge,” said Martin Mucci, Paychex president and CEO. “With employment growth continuing to show moderate declines, we’re seeing first-hand the impact of the tightening labor market on small businesses.”

Broken down further by geography and industry, the October report showed:

- The top regions for employment growth and wage growth, respectively, are the South and West.

- Texas ranks highest among states for jobs growth; Arizona ranks first in wage growth.

- Denver remains first among metros in jobs growth; Phoenix regained the lead in wage growth.

- The index for Construction has now been above 100 for seven years.

The complete results for October, including interactive charts detailing all data at a national, regional, state, metro, and industry level, are available at www.paychex.com/employment-watch/. Highlights are available below.

October Paychex | IHS Markit Small Business Employment Watch

National Jobs Index

- Small business job gains continue to slow, declining 0.06 percent further in October to 99.12.

- The national index has fallen by 1.65 percent since its recent peak in February 2017.

National Wage Report

- At 2.41 percent, hourly earnings growth increased for the second straight month.

- Weekly earnings growth slipped to 2.53 percent, impacted by the decrease in weekly hours worked growth, which fell for the first time since 2016.

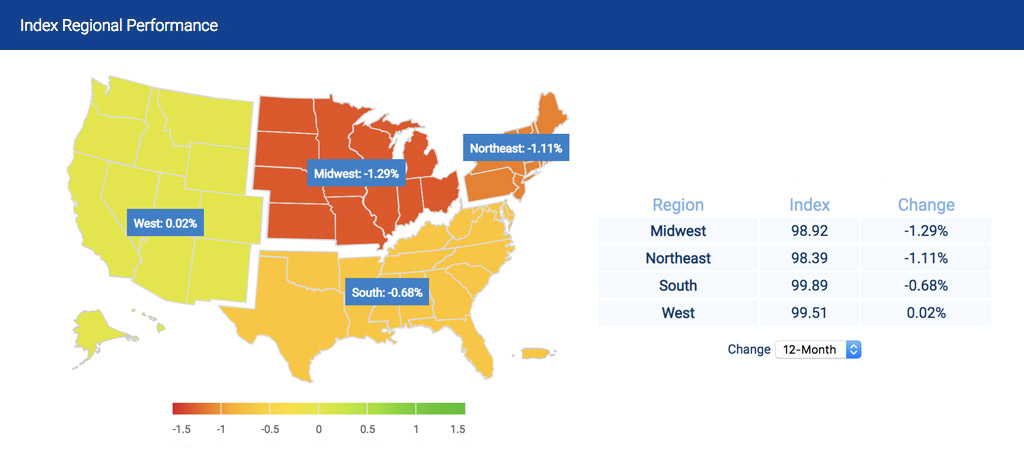

Regional Jobs Index

- The Northeast and Midwest had the steepest declines, down the most among regions in October and from last year.

- The West ranks second among regions, at 99.51, but is the only region to show year-over-year improvement in the pace of small business job growth.

Regional Wage Report

- The West continues to lead hourly earnings growth at 3.24 percent, while the other regions are less than 2.50 percent.

- The Midwest has shown a marked acceleration in hourly earnings growth during the past two months, improving from 2.05 percent to 2.47 percent.

State Jobs Index

- Leading all states, Texas and Arizona had strong gains in October and are the only two states with positive year-over-year growth.

- Pennsylvania (98.00) and Massachusetts (98.09) trail all states in small business employment growth.

State Wage Report

- At 3.41 percent in October and averaging 3.42 percent during 2018, hourly earnings growth in California has been very consistent.

- Above three percent in October 2017, Texas’ hourly earnings growth has decelerated quickly to 1.31 percent.

Metroploitan Jobs Index

- Denver and Phoenix lead in job gains, with Dallas, Houston, and Tampa also showing strong growth with index levels above 100.

- With its fourth strong gain in the past six months, San Francisco improved to 99.68 and is up 2.31 percent from last October.

- At 97.36, Philadelphia has fallen to the lowest metro ranking, down nearly two percent during the past quarter.

Metropolitan Wage Report

- Phoenix; Riverside, CA; and Denver lead metros with wage growth above four percent.

- Houston and Dallas have the lowest hourly earnings growth rates among metros.

Industry Jobs Index

- At 97.84 and down 0.42 percent in October, Manufacturing slowed further as the lowest-ranked sector.

- At 100.10 and very steady during the past quarter, Construction has now been above 100 for seven years.

Industry Wage Report

- After strong gains in 2017, wage growth in the Other Services (except Public Administration) sector has slowed dramatically. It is currently below one percent in October 2018.

- Like job growth, wage growth in Construction has been solid and consistent. Hourly earnings growth has been just above three percent since April 2017.

Note: Analysis is provided for seven major industry sectors.

Thanks for reading CPA Practice Advisor!

Subscribe Already registered? Log In

Need more information? Read the FAQs